PLEASANT HARBOR

Giving Through Jefferson Community Foundation

Donate from your IRA RMD.

Are you over 72 years old and have an IRA(s) from which you and/or your spouse have to take a required minimum distribution (RMD)?

Are you concerned that the increased taxable income from this RMD may put you into a higher tax bracket or into a higher income level that may increase your Medicare payment?

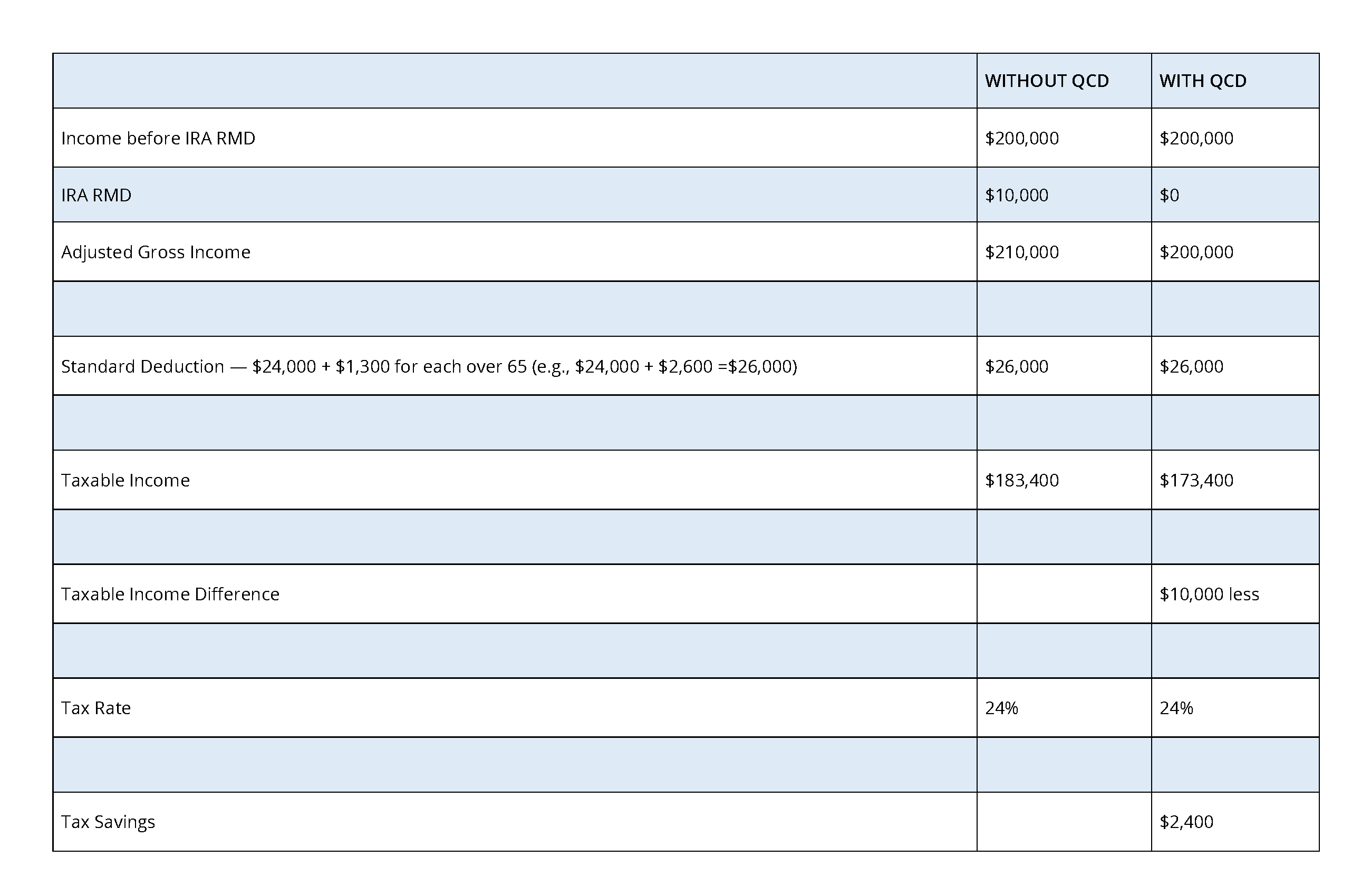

To lower your taxable income and contribute to a qualified charity, consider contributing that RMD directly to a qualified 501(c)3 charity. And you will not have to count that RMD as taxable income at all.

The transfer from your IRA to the charity must be a direct transfer. You may not have the funds made out to you. The check from your IRA must be made out directly to the charity.

This is a qualified charitable donation — A QCD. So make a QCD with your RMD and come out ahead. (Note: you can start making QCDs at age 70 1/2; the RMD starts at age 72.)

You can designate the Jefferson Community Foundation as the recipient of your QCD.

Contact the Community Foundation for more information. You can email us at info@jcfgives.org or call us at (360) 885-1729.

Here is an example of how it might work — remember to check with your tax advisor for your specific situation.

GIVING

THROUGH JCF

FUNDHOLDER

SERVICES

OPEN A FUND

DONATE TO

A FUND

LEAVE A

LEGACY

FOR

PROFESSIONAL

ADVISORS